The New eCommerce Playbook for 2022 Featuring Top SEO Trends

The COVID-19 pandemic provided a decisive push towards eCommerce adoption. Extended closures prompted even the most reluctant consumers to shop online, from major purchases like cars to everyday ones like groceries . In fact, a full 75% of U.S. consumers tried different websites or brands during the pandemic, and most of them expect to keep using them long after the pandemic. And the eCommerce industry added $219B in sales in 2020 alone.

In such a competitive environment, a robust eCommerce SEO strategy is key. We’ve written extensively about the strategic value of organic marketing in 2022, especially as it relates to online shopping.

In this post, we take a retrospective look at organic eCommerce traffic since the start of 2020. As we enter year three of the pandemic, our analysis provides a birds-eye view of the industry, as well as insights into how brands can adapt to an ever-changing environment.

Methodology

For this analysis, we analyzed 16 eCommerce domains within Google Analytics. We selected these domains to be representative of the full breadth of the eCommerce industry, ranging from direct-to-consumer brands (like Casper) to brand-agnostic retailers (like Mattress Firm). Around 75% of the companies analyzed are enterprise with the remainder falling into the mid-market category with 500-1,000 employees. We pulled data from February 2020 (pre-pandemic) to March 2022 (for which only partial data is available).

eCommerce Traffic Trends: The End of the Boom?

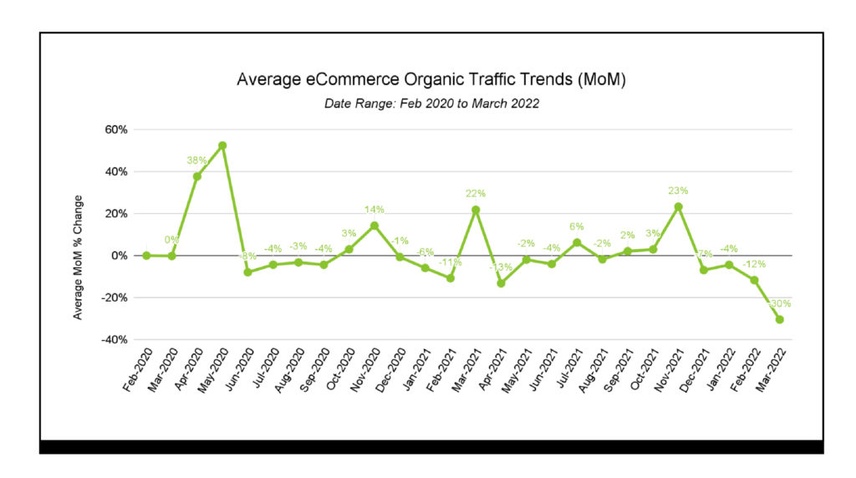

First, we assessed month-over-month change in organic traffic for eCommerce domains from February 2020 onwards:

A huge spike in traffic to these sites is apparent for the first few months of the pandemic. But has this held up?

Comparing the year-over-year (YoY) change from February 2020 to 2021, we see a significant increase of 39% in organic traffic. And despite recent monthly declines, there is still a net increase of 23% in organic traffic when comparing February 2020 to 2022. That is, eCommerce organic traffic is still higher now than it was before the pandemic.

We also found significant dips in search traffic between November and December in both 2020 and 2021. This likely reflects the fact that consumers are moving their holiday shopping earlier, both to take advantage of deals and to account for shipping delays. In fact, in 2020 42% of people said they started their holiday shopping earlier than in previous years. It appears that more consumers are completing their shopping in November, causing a slight drop-off in traffic the following months.

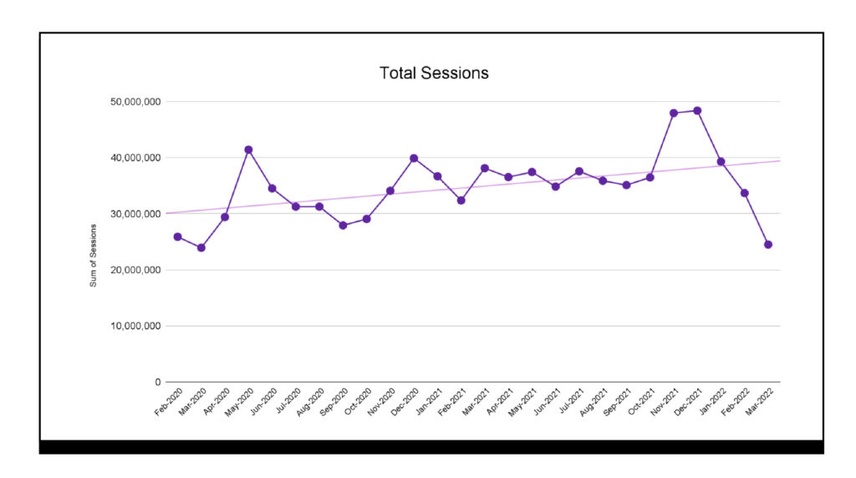

In addition to the above monthly change data, we also examined total sessions across all analyzed sites:

Total sessions peaked in December 2021, with a net increase of 21% from the previous year. The trend line makes it clear that the pandemic has accelerated organic eCommerce traffic overall. But both this and the previous monthly change charts indicate that the rate of eCommerce growth may be slowing.

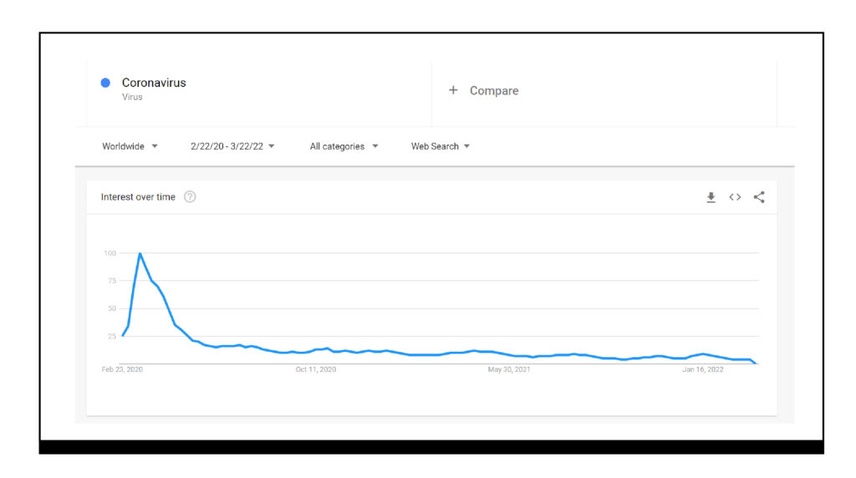

The decreasing eCommerce growth rate may be linked to a national decline in pandemic precautions. After the omicron surge in late 2021, states across the U.S. began rapidly lifting COVID restrictions. Mask mandates began to fall and the CDC changed its reporting to reflect COVID as an endemic disease. Attention seems to be shifting away from the pandemic, as reflected by the global decline in “coronavirus” search interest.

The combination of easing restrictions and changing media focus has led to analysts predicting a surge in retail foot traffic by March 2022. Macy’s, for example, planned to close 125 stores during the pandemic. But they recently reported that, while overall in-person visits were down, each open location was receiving more visits .

The resurgence of in-person shopping could account for the slight decline in eCommerce growth rate. Of course, it’s important to note that online shopping traffic is still higher than it was in 2020, and is not going away. Customers now expect retailers to provide seamless online and brick-and-mortar shopping experiences, a demand that is reflected by changes to ranking content on search engines.

eCommerce content trends: new rankers & result types

In this section, we analyze the market share and SERP volatility for eCommerce-related searches from 2020 through 2022, revealing some surprising trends.

Changes in search intent and ranking content

We discovered a major shift in market share for short-tail searches (also known as head terms), which are searches that contain just one or two words, between 2020 and 2022. These terms are extremely competitive, with significant search volumeSearch Volume

Search volume refers to the number of search queries for a specific keyword in search engines such as Google.

Learn more and high costs per click.

We found that there has been a shift from transactional to informational results for head terms since 2020. What does this mean? Consider the term “printers:”

In March 2020, Google returned URLs from retailers like Walmart and Amazon that contained lists of printing-related products. These are transactional results, with direct opportunities for consumers to convert by adding items directly to their cart.

In March 2022, that same search surfaced content from sources like PC Mag and CNET. From “Best Printers for 2022” to “Printer Buying Guide,” these are informational sources, providing readers with the answers they need to make a purchase down the line.

The trend towards informational content is occurring across many other short-tail searches in Conductor’s index. It’s clear that Google has begun to interpret these head terms as early-funnel searches rather than signs that a consumer is ready to purchase. Early-stage content is increasingly vital for eCommerce companies to rank well.

Casper, the disruptive mattress brand , has effectively prepared for this shift with a robust content strategy. Since the beginning of the pandemic, Casper’s blog has become one of the top traffic-driving sections of their site. Between buyer’s guides on finding the right mattress size to informative content like how to get urine out of a mattress , the blog generates close to a million organic clicks per month. Casper has also significantly increased their ownership of both People Also Ask and Answer Box result types in the last three months—by 95% and 92%, respectively. Their investment in content is paying dividends in the current eCommerce environment.

New eCommerce result types

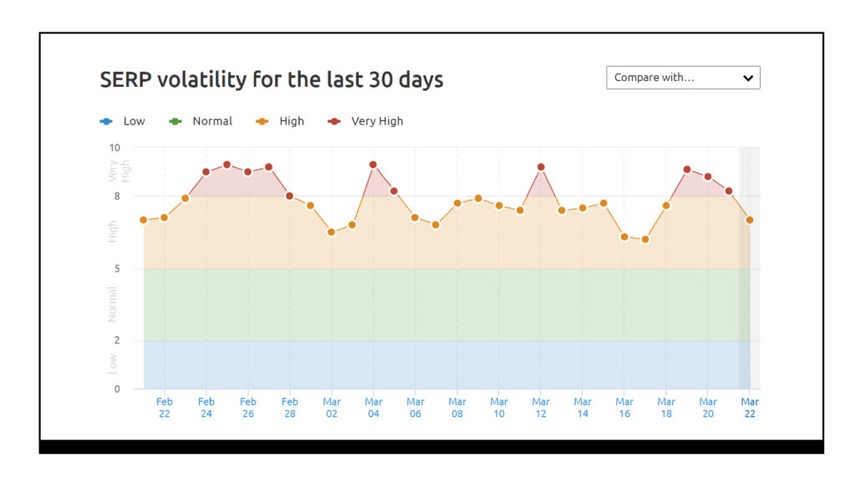

Next, we assessed the volatility of eCommerce search results using the search engine result page (SERP) volatility feature of our partner SEMrush. The below chart tracks dramatic rank fluctuations for shopping domains in March 2022:

We frequently see such volatility in the case of algorithm updates. But fluctuation can also signal that Google is experimenting with new features on the SERP to improve the online shopping experience. We’ve identified several result types that are increasingly prevalent in the eCommerce space.

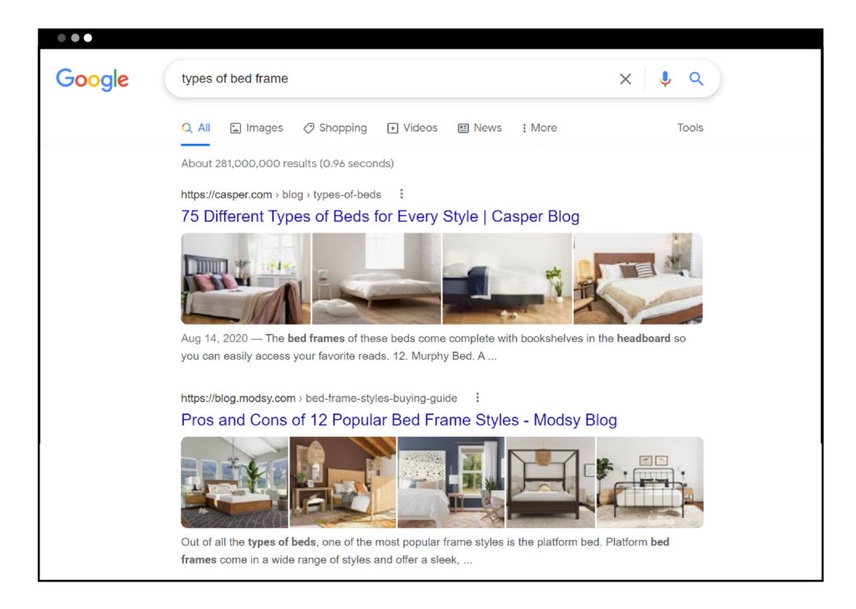

Google now pulls images directly from relevant retailers and places them on the SERP, even for non-image queries. For example, here are the results for “types of bed frame”:

Casper’s blog is ranking first, with images from that page displayed front and center. Google is able to understand and pull these photos because Casper has properly optimized the images across their site.

- Search Strategy Tip: eCommerce companies should employ alt tags and keyword-rich file names to their images to help improve rankings.

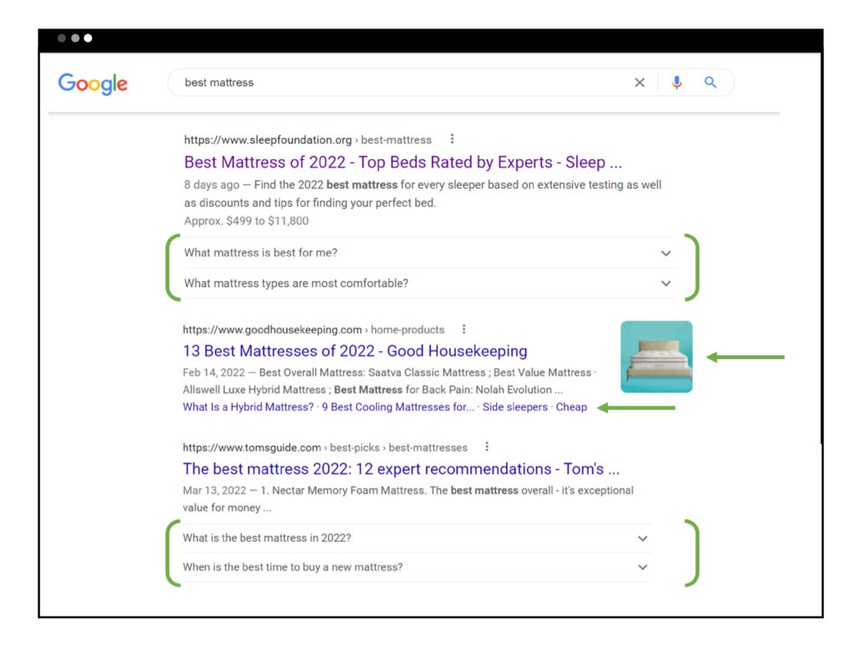

FAQ accordions are another important eCommerce result type. They appear for searches like “best mattress:”

Sites like Tom’s Guide have effectively optimized their pages to surface FAQs on the results page. Proper schema markup is essential for helping Google understand your site’s assets. Schema is code that clarifies on-page content, providing context for Google and improving customer experience and conversions.

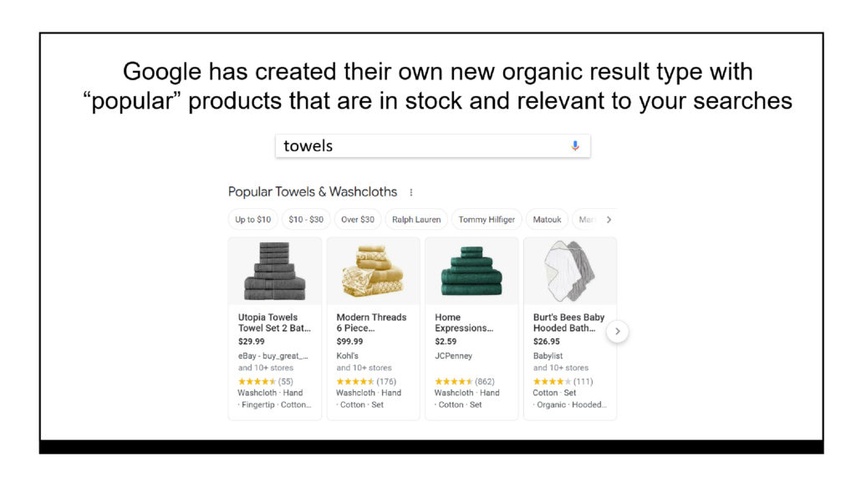

Google has introduced so-called “popular” shopping results that look similar to paid advertisements, but are based on organic:

The search engineSearch Engine

A search engine is a website through which users can search internet content.

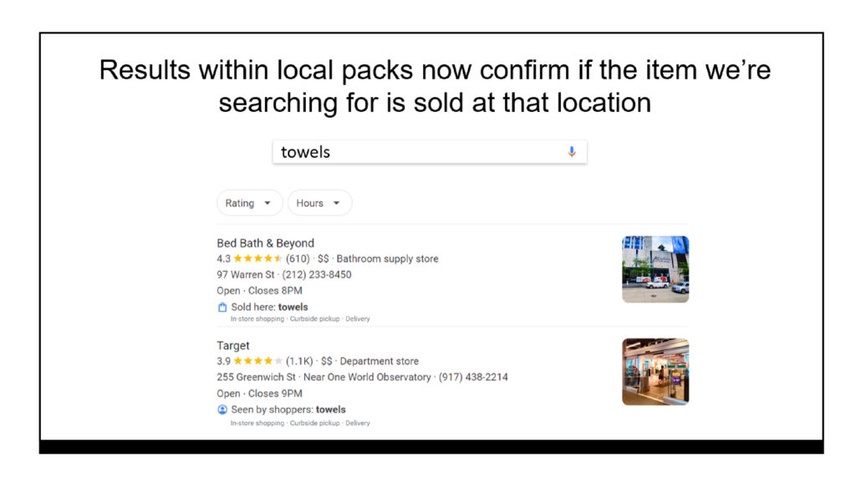

Learn more has also combined shopping results with local result types by letting us know if the particular item we’re searching for is available at the local results appearing:

These new result types teach us a few things. First, it is no longer optional to use schema markup to tell search engines about the products on your site. Second, tools like Google My BusinessGoogle My Business

Google My Business is a product by the Google search engine.

Learn more and Google Merchant Center are crucial for getting your products featured in these new result types. Maintaining proper data on your products ensures that customers have a unified experience, receiving the most up-to-date prices and availability both in-person and online. Optimizing for Google’s new eCommerce result types will help ensure that your products appear to the right person at the right time.

Conclusion

Two key trends emerged from our research:

- The eCommerce boom may be slowing, but online shopping is not going anywhere. Traffic is still significantly higher than it was before the pandemic.

- eCommerce search results are volatile due to new SERP features that attempt to bridge the gap between online and in-person shopping.

These trends should not be a reason for concern; they are simply signs of stabilization into a new normal. Online retailers should follow industry best practices by investing in content that provides real value for their customers and technical improvements that make that content legible by search engines. Platforms like Conductor can provide actionable data and expertise on the latest trends in eCommerce. Schedule a demo today to learn more.