The 2024 Organic Search Traffic Benchmarks Report

Comparing your enterprise website’s organic performance to the latest SEO benchmarks is the best way to contextualize YTD data and adapt strategies to maximize results.

Ensure your organic search strategy is set up for success for the remainder of 2024 and beyond by seeing how your website performance stacks up against the latest organic search traffic and SEO benchmarks by industry and subindustry.

Get the latest AEO/GEO trends, market share leaders, and benchmarks in the 2026 Benchmarks Report.

Why use SEO benchmarks to set objectives?

There are typically two types of SEO benchmarks to help you understand your organic search performance better. The first type of SEO benchmarking involves comparing your current website metrics, like organic sessions, conversions, and keywordKeyword

A keyword is what users write into a search engine when they want to find something specific.

Learn more rankingsRankings

Rankings in SEO refers to a website’s position in the search engine results page.

Learn more, to your historical metrics on a yearly, quarterly, or monthly cadence, which is a singular view of your brand’s progress. The second type of SEO benchmarking compares your brand against an average industry standard, which is the focus of our annual Organic Search Traffic Benchmarks Report.

SEO benchmarks by industry are a valuable way to compare your brand to competitors within the same space, fine-tune your content strategy to maximize visibility on SERPs, better understand website traffic trends, and increase organic search traffic and overall digital visibility.

Leveraging organic website traffic benchmarks also helps you understand where your domain stands within your related industry and the effectiveness of your SEO strategies. Use the latest SEO benchmarks provided in this report to assess your organic search performance and adapt your KPIs accordingly.

Organic search traffic benchmarks by industry

Website traffic comes from various channels, including organic search, direct, paid, referral, and social. Organic is arguably the most crucial form of traffic since it connects the right audience—with the right search intent at the right funnel stage—to your website via SERPs and helps you answer the questions your customers are asking. It’s also the only channel that produces reliable, long-term traffic. Unlike paid campaigns, there is no end date for the lifespan of a piece of content. An effective piece of value-driven, optimized content can continue to rank well for years.

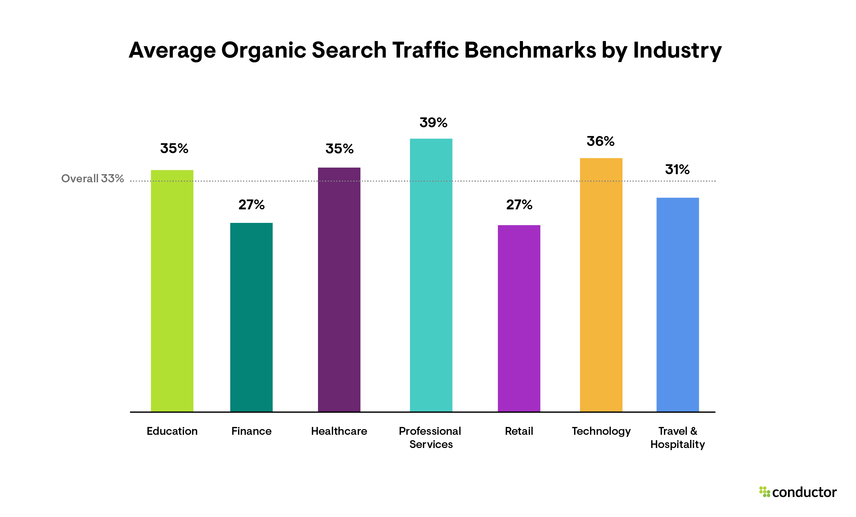

For the 2024 Organic SEO Industry Benchmarks report, we analyzed over 800 domains and categorized them into seven industries: education, finance, healthcare, professional services, retail, technology, and travel & hospitality.

We found that, on average, organic search produces 33% of overall website traffic for these seven key industries.

Branded vs. non-branded: Organic search traffic benchmarks by industry

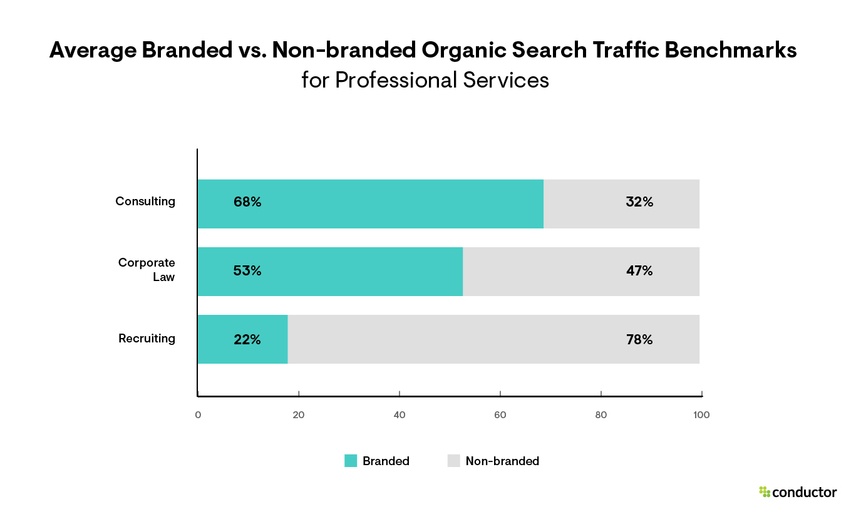

To understand organic search traffic trends and evaluate your site’s organic search performance, brands must also look at the branded vs. non-branded breakdown within organic search traffic. This provides the best opportunity to contextualize your results and see where you can leverage paid and organic synergy to increase ROI and drive brand awareness while conserving paid spend for the hyper-competitive keywords you aren’t able to rank for organically.

Each subindustry analyzed in our 2024 SEO benchmarks report includes average branded vs. non-branded organic traffic benchmarks and overall average benchmarks for the industry. The branded and non-branded organic traffic benchmarks for the professional services industry below show just how much these averages can vary by subindustry.

The overall average industry-specific branded and non-branded benchmarks are a helpful tool for understanding what split to target when just starting to dig into these organic traffic analytics. Enterprise brands with a more advanced SEO strategy should base KPIs on the subindustry-specific rates rather than the overall industry averages for a more accurate comparison to how other direct (and indirect) competitors are pacing.

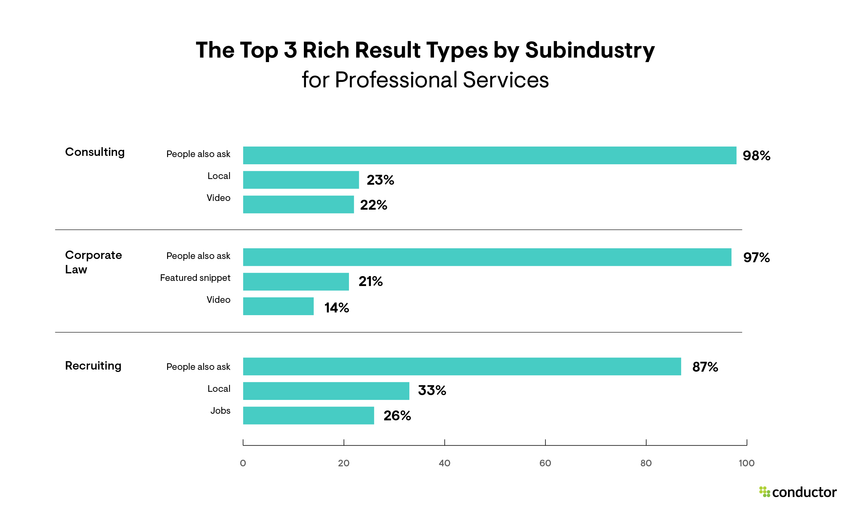

Top 3 rich SERP result types by industry

Understanding the most prevalent rich search result types for your subindustry can be an effective way to gauge if you’re providing the best information—in the right format—for your target audience. Assessing rich search resultSearch Result

Search results refer to the list created by search engines in response to a query.

Learn more trends for your vertical also helps highlight opportunities to create or optimize content for in-demand content types. We analyzed the prevalence of rich search result types for each subindustry using Conductor Intelligence to identify the three that appear most often.

The People also ask result type appeared most often for 24 of the 26 subindustries analyzed. This is why in-depth keyword research is vital to ensure you answer your target audience’s most common questions and related follow-up questions in your content.

One notable trend identified in our 2024 analysis was the month-over-month increase in search queries triggering the Video result type for a variety of subindustries across multiple industries, including corporate law, as shown above.

For corporate law, the increase in video results on SERPs could indicate that users want to hear directly from legal experts about commonly asked questions rather than reading long-form content. Creating helpful, straightforward videos with different lawyers at the firm can help put a human face on your services, increase organic search visibility, and build trust among your audience. This is just one example of how to translate this data into actionable takeaways to improve your SEO and content strategies.

Optimizing your content to target your industry’s most prevalent rich result types can substantially increase organic traffic as these result types appear at the top of search results—the most coveted space on SERPs. Consider adapting your content strategy to account for your industry’s top result types and format content accordingly.

Methodology

Using Conductor Intelligence, we analyzed over 800 enterprise domains and categorized them into seven industries. These industries were further categorized into 26 subindustries to provide granular-level insights.

As highlighted above, the data in our 2024 benchmarks report has been split into seven industries: education, finance, healthcare, professional services, retail, technology, and travel & hospitality. When deciding which industries—and corresponding subindustries—to feature, we considered a variety of factors. The industries selected were identified as top economic drivers; they are expected to drive significant revenue growth over the next 5-10 years.

The 26 subindustries selected were the most competitive sectors among the core industries listed. Certain subindustries, like car rentals, were not included due to the limited competitionCompetition

Businesses generally know who their competitors are on the open market. But are they the same companies you need to fight to get the best placement for your website? Not necessarily!

Learn more within the grouping (e.g., three primary parent companies owned all major car rental brands in the U.S.).

New to this year’s report is the education industry. We have also expanded the subindustries within retail to include luxury apparel, hybrid department stores (brick and mortar along with eCommerce offerings), and online-only department stores. This was done to provide benchmarks for department store giants like Target, Walmart, Amazon, and more that would otherwise skew standard subindustry categories like apparel or consumer electronics with abnormally high rates. We have also included our initial findings on the impact of Google’s AI Overviews since the May 2024 rollout.

The initial findings in this report on organic search traffic, branded vs. non-branded breakdowns, and average organic search traffic values are based on global website traffic data for desktop devices. These benchmarks are an average sourced from an analysis of monthly organic search traffic data over the last 12 months (June 2023 - May 2024) in Conductor Intelligence and Semrush, one of our certified platform partners.

The top rich search result types and top content provider data are based on U.S.-specific organic search data in Google during May 2024. To identify these results, we analyzed over 400K search queries, accounting for over 26B in monthly search volume, in Conductor Intelligence.

This report is a snapshot of the evolving organic search landscape and SEO benchmarks by industry for 2024.