The Top Finance Search Trends in the U.K. for 2022

Discover the key players and search trends across financial service verticals in the UK from the latest search data in the financial sector.

Financial services remain a bedrock of the U.K.’s economy. In 2021 the sector contributed £132 billion to the U.K. GDP , comprising nearly 7% of total economic output—even more so in London. Like most industries, it is rapidly changing in response to both new technologies and global events.

At Conductor, we regularly analyze the latest search data from the financial sector. Early in 2022, we produced a major report on the state of the financial services industry in the U.S.

Now it’s time to shift our focus to the U.K. We researched a set of 12,947 words and phrases across 4 categories: retail banking, financial technology (fintech), loans & mortgages, and investments. We begin with a general overview of the industry, and then perform a market share analysis of each subcategory.

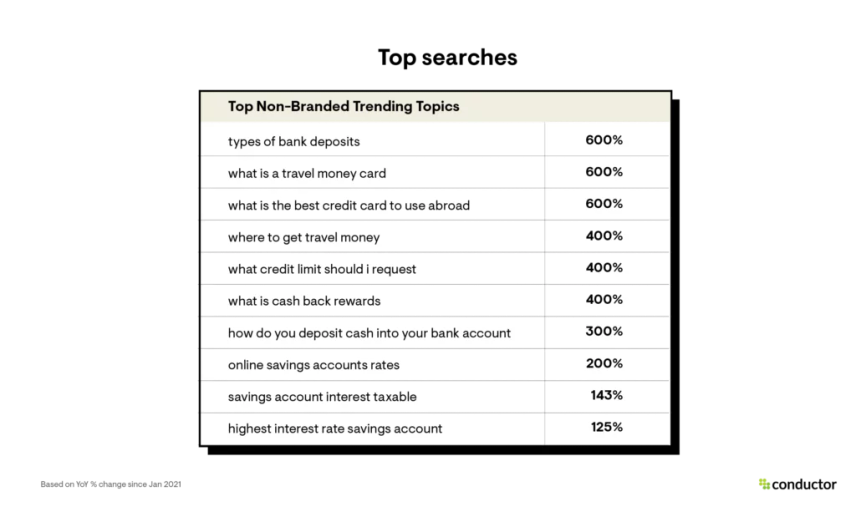

Retail banking trends

Digital transformation is key for retail banking. The COVID-19 pandemic accelerated consumer adoption of digital banking services, since most brick-and-mortar branches closed for a time to comply with public health measures. Many branches never reopened —banking executives realised they could invest in improving digital services instead. With digitisation comes increased concern about cybersecurity and privacy, especially in an era of increased cyber attacks .

U.K. consumers also face issues like lack of savings, over-indebtedness, and limited financial knowledge . Retail banks should focus on providing information that helps these customers.

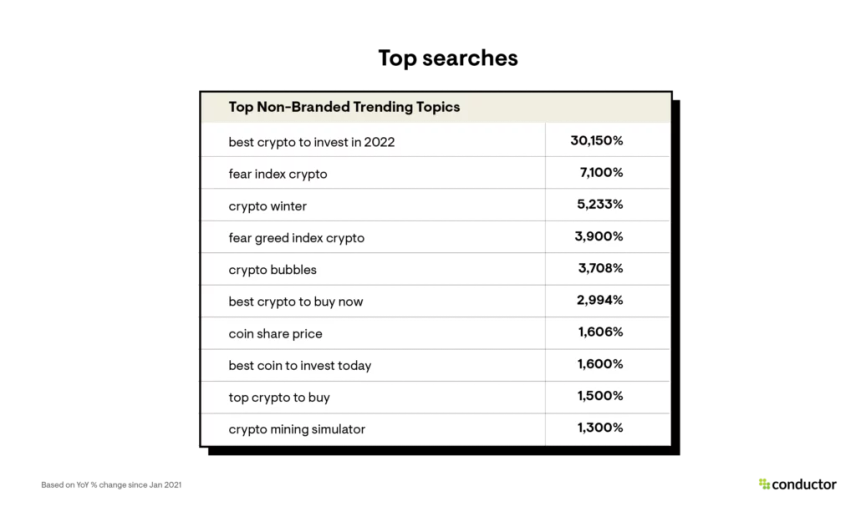

Fintech

In 2022, new technology continues to disrupt existing financial systems. From online banking-as-a-service (BaaS) to cryptocurrency to digital payment solutions, the only constant in this industry is change.

Upstarts like Monzo, Revolut, and Starling Bank barely appear for our sample set. They perform well for branded queries, but do not yet have the authority to appear for non-branded early-funnel searchers.

Crypto wallets like Coinbase dominate the crypto category, while startups like GoCardless compete with more established players like Square for payment technology market share. Firms such as IBM, Deloitte and PwC are seen as experts in blockchain technology.

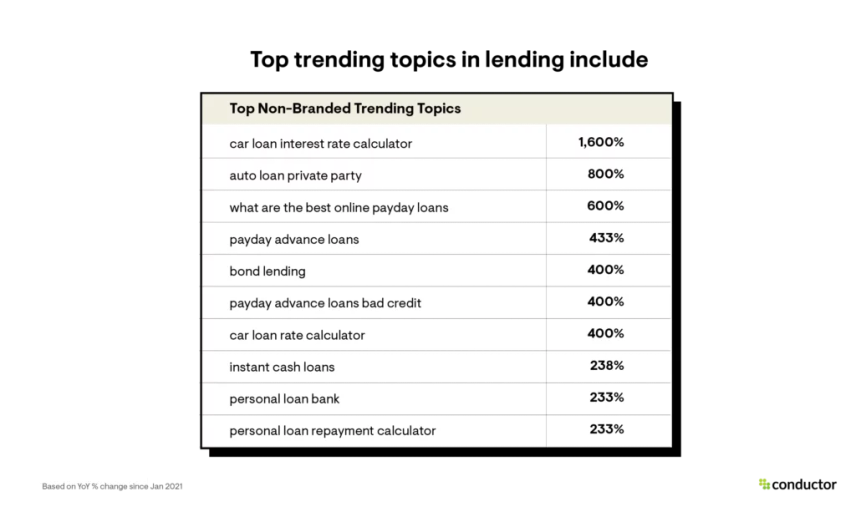

Loans & mortgages

Lending is also changing with the times. The U.K. property market is booming—2021 was a record year for mortgage lending, but demand has cooled a bit in 2022, possibly because of rising prices. This has led to fluctuation in demand for mortgages.

Meanwhile, increasing consumer debt in the U.K. has led to an uptick in personal and payday loans, as people need cash in hand for big purchases or daily essentials.

As with overall market share, calculators are crucial across the board. For the personal loans category, several banks appear for the first time in this analysis—Tesco and Santander—that are both winning with quality calculator content.

Two clear emerging categories appear in the data: payday loans, and car loans. While determining causality is complicated, it’s likely that COVID has impacted both of these areas. The pandemic had a significant impact on household finances , depleting incomes and increasing costs. It is likely that payday lending has stepped in to fill the need for instant cash in hand.

Investments

2022 is an exciting time for investors. New assets like cryptocurrencies and NFTs promise to reshape commodity investing and even retirement portfolios , while meme stocks threaten to disrupt traditional investing wisdom.

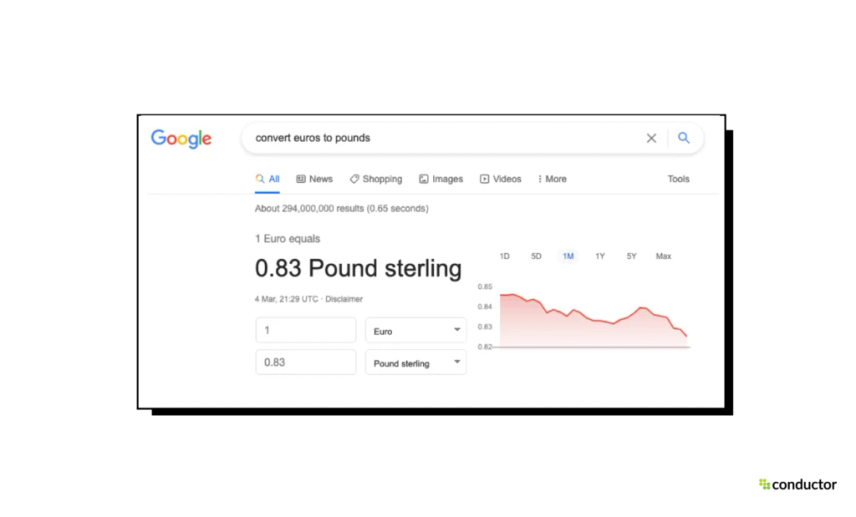

The stocks subcategory is dominated by publishers, while ETF topics return brokerages like Vanguard and Fidelity. For forex terms, industry-specific players like Forex.com and ForexFactory.com rank well. However, Google returns a proprietary result type at the top of the SERP for most forex searches:

This likely lowers the clickthrough rate for ranking sites, since many consumers will get the information they need without leaving the SERP. This is not necessarily cause for despair, however. It may be that, while fewer people are clicking through to industry sites like ForexFactory.com, these are high-value, high-expertise customers that are even more likely to convert and return to your site. It is important to consider persona when targeting topics in the financial services sector.

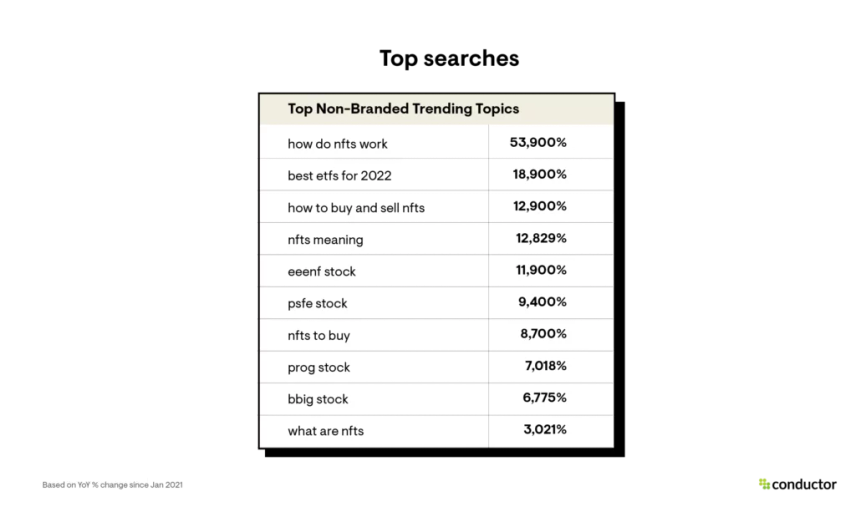

One category stands out above all others—NFTs. We will look back on 2021 as the year the NFTs exploded from niche assets to pop culture touchstones.

We can also trace stocks that had significant years this way. For instance, “BBIG stock” is up nearly 7,000% since last year. Vinco Ventures (NASDAQ: BBIG) is a long-running meme stock, and it has had an extraordinarily volatile year on several fronts. This has generated interest that is reflected in search data.

Find out who is owning the market

This is just a sample of our report. Download the full report to access the valuable insights on the latest trends in the UK finance industry going into 2022.

- Discover the top performing domains overall and by subcategory.

- Learn about the types of content that perform well in order to inform your own content marketing strategy.

- Correlate the latest developments in the financial services sector with trends in organic search data.