COVID-19 Search Trends in 2022: Snapshots From the Age of Omicron

COVID-19 developments have created new search trends. We analyze search data to draw insights about consumer concerns in the age of Omicron.

New variants, vaccine boosters, and travel restrictions: the COVID-19 pandemic seems to be ramping as 2022 begins.

After two long years of disruption, people around the world still have questions. They want to learn how to keep their families safe and even thrive in these challenging times. As always, they are turning to Google to provide answers.

At Conductor, we know that search data yields important insights about the state of the world. This was underscored when medical researchers in 2020 used Google data to correlate rates of people searching for “lost smell” with upticks in COVID cases. In that instance, search trends led to the discovery of a previously unknown COVID symptom.

Conductor regularly combs through search data to better understand how people are thinking about the pandemic. In early 2021, we analyzed troves of data to determine the top questions being asked about COVID at that point. We even created a COVID-19 resource hub to consolidate all our research on the pandemic’s impact on various industries.

In this post, we update the data for the age of Omicron. We examine how people are searching for the new variant and booster shots. Then we explore the different facets of daily life under an ongoing pandemic, highlighting the connections between search data, breaking news, and government policy.

The Omicron Variant

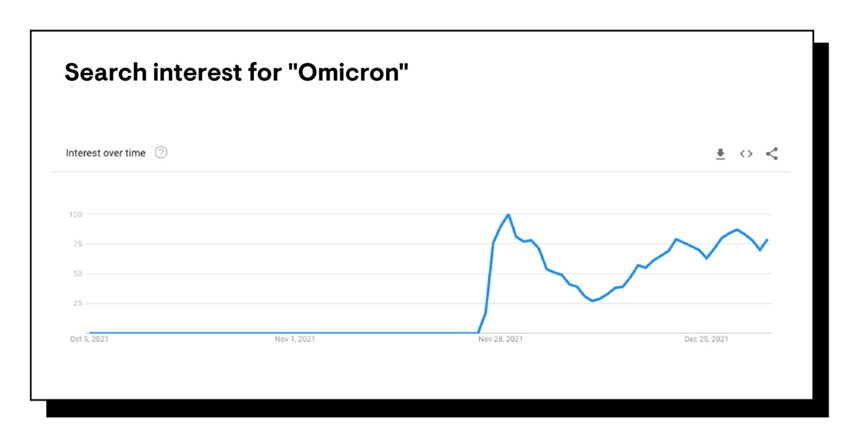

Google Trend data can help determine the onset of public awareness of new variants. First, we examined global search trends around the term “Omicron.”

Interest appears to have peaked in late November 2021 with reports of Omicron’s emergence . It then dropped off slightly and has been steadily rising since mid-December. This tracks with Omicron’s eventual global spread.

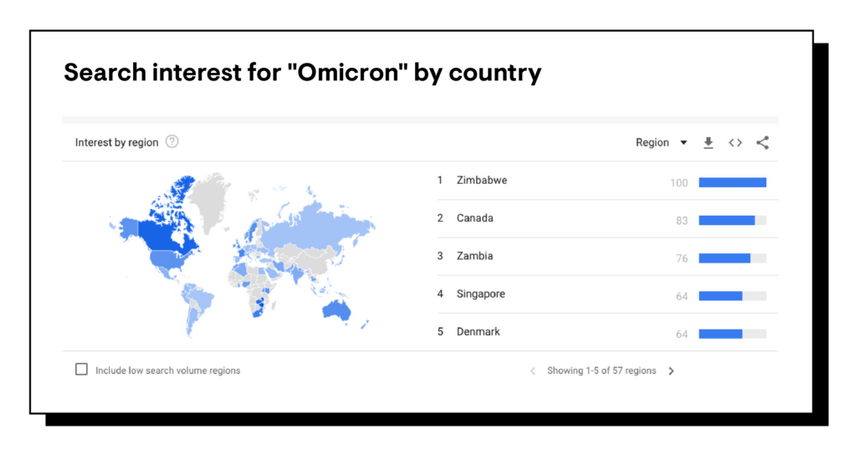

We then broke down search interest in Omicron by country, revealing some interesting trends.

Countries in southern Africa, like Zimbabwe and Zambia, have far more relative search interest in Omicron than the U.S., which sits at number fourteen on the list. Given that the Omicron variant was first identified in southern Africa and caused case numbers to rise earlier there, it makes sense that search volumeSearch Volume

Search volume refers to the number of search queries for a specific keyword in search engines such as Google.

Learn more would be high in the region.

Interestingly, Canada sits at number two on the list. Perhaps our northern neighbor’s robust public health response is causing more people to search for the variant there.

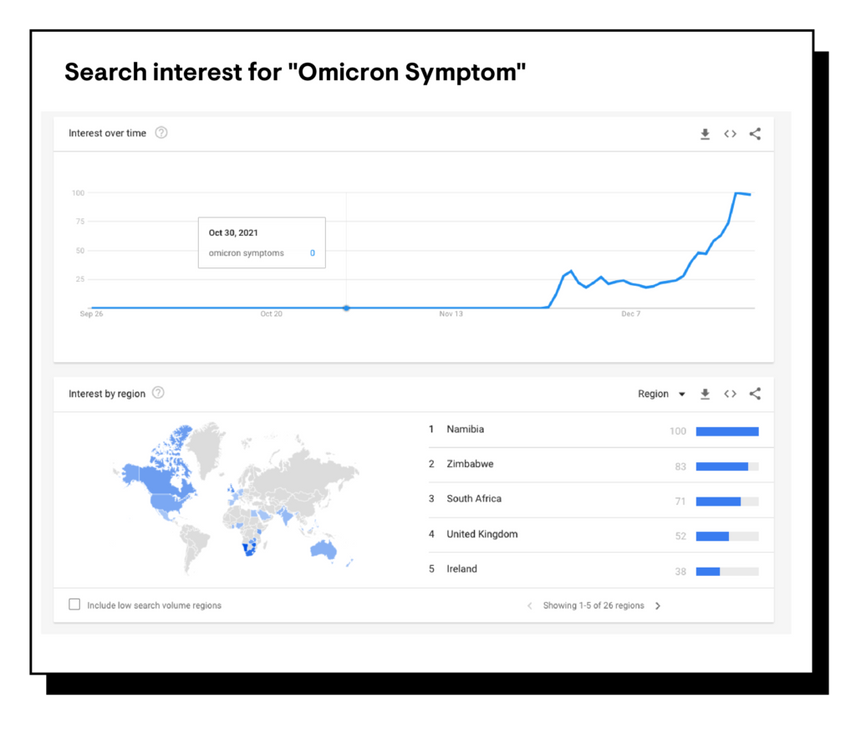

While Omicron search interest peaked in late November 2021, “Omicron symptom” interest did not peak until a month later, in late December. This suggests a slight lag between general Omicron searches and symptom-level searches.

Why the delay? The variant takes time to become dominant once it is identified. Only when people start to become infected with the variant do they begin to search for information about symptoms. This gap between awareness and symptom searches is reflected in the search data.

Google’s own geographic data also supports this theory: South Africa and the United Kingdom—both hit early by Omicron—have the highest relative search interest for symptoms. We predict that relative interest in “Omicron symptoms” has peaked in the U.S in mid-January 2022, but we’re also aware that Omicron still has room to grow if the right precautions aren’t taken.

Search Interest for COVID-19 Vaccines

Booster Shots

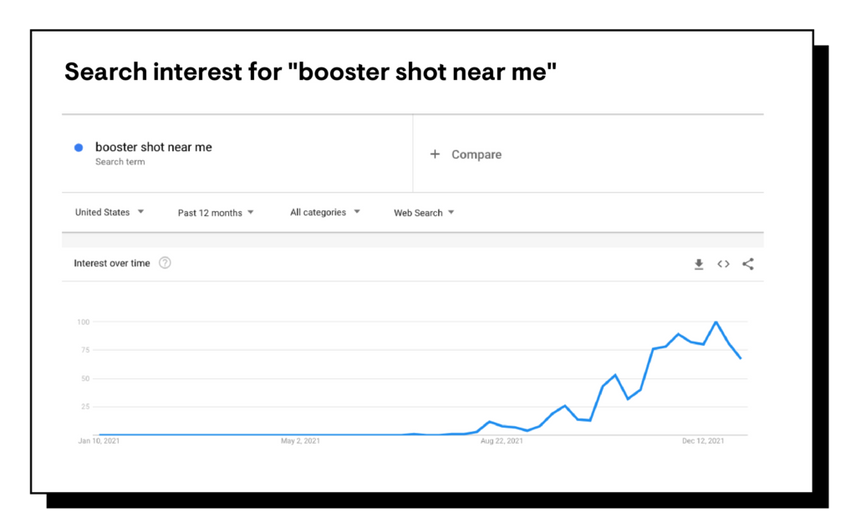

The emergence of Omicron has brought a shift in thinking about COVID-19 vaccines. Governments around the world are now promoting “booster shots” of mRNA vaccines (Moderna and Pfizer) as the best way to prevent hospitalization and death from the new variant. In fact, many now consider the booster to be an essential part of the vaccine regimen.

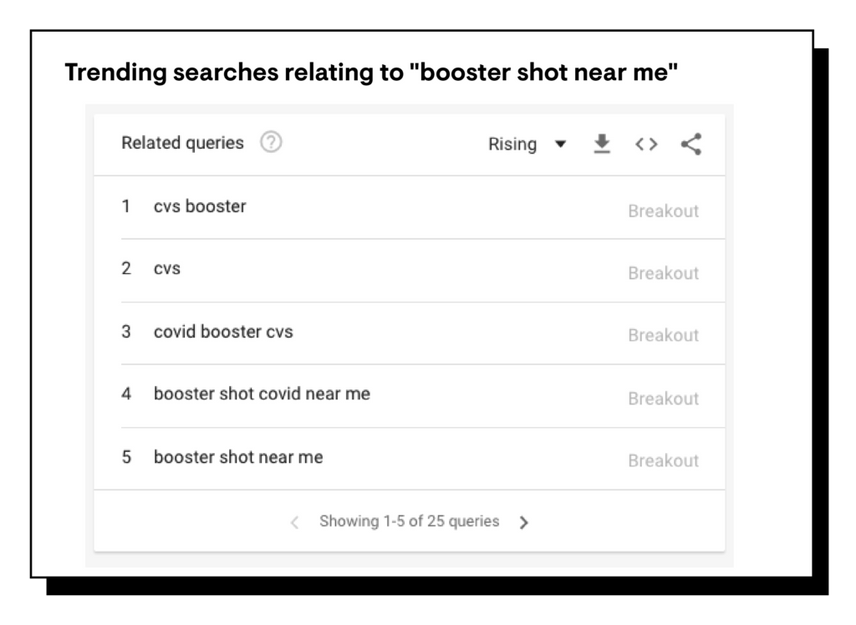

This new information is reflected by the rising search trends of people looking to find a booster shot near them in the U.S.

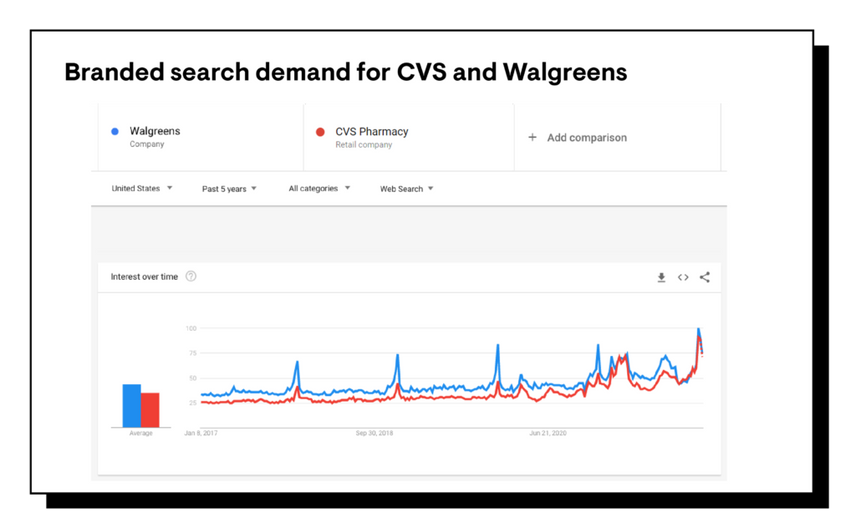

They are also looking for pharmacy-specific appointments, most commonly at CVS. This reflects the U.S. government’s strategy of partnering with private pharmacies for vaccine distribution. In fact, branded search for these pharmacies is booming, with both CVS and Walgreens seeing higher search interest than at any point in the past five years. This is undoubtedly related to their status as vaccination hubs.

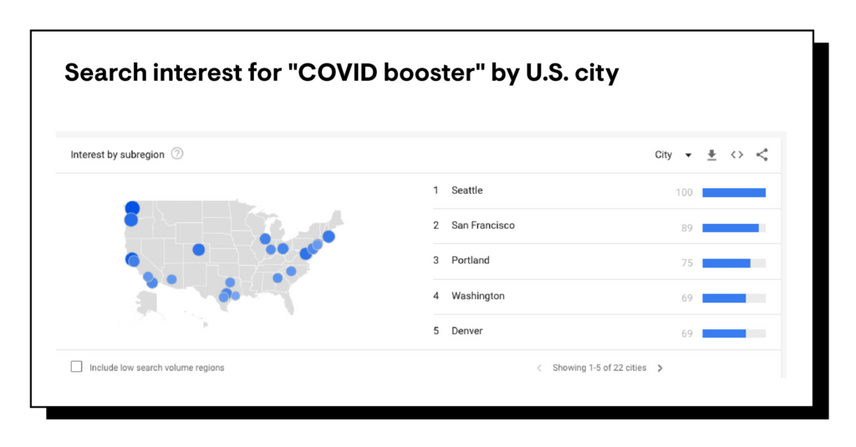

Next, we examined the distribution of interest around the term “covid booster” in different cities in the U.S.

We found that the cities with the highest search interest in covid boosters were clustered on the West Coast, with Seattle, San Francisco, and Portland comprising the top three.

Vaccine Brand Comparison

Is there a difference in demand between the two main mRNA vaccine brands, Moderna and Pfizer? First, we assessed relative interest in the U.S. between the different types of boosters (“Pfizer booster” in blue, “Moderna booster” in red).

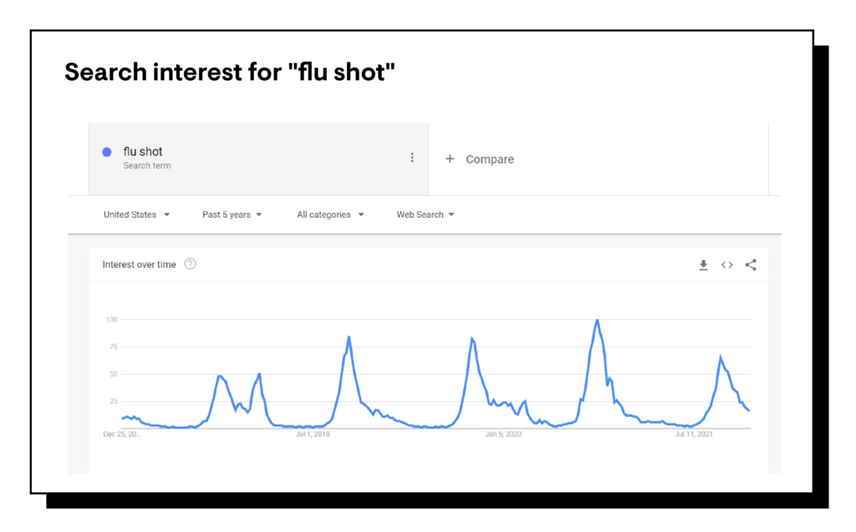

It could be that increased public health messaging around vaccines, in general, led to an upswing in flu vaccine interest as well. But given that flu shot interest actually decreased in fall 2021, it’s also possible that people are experiencing vaccine fatigue.

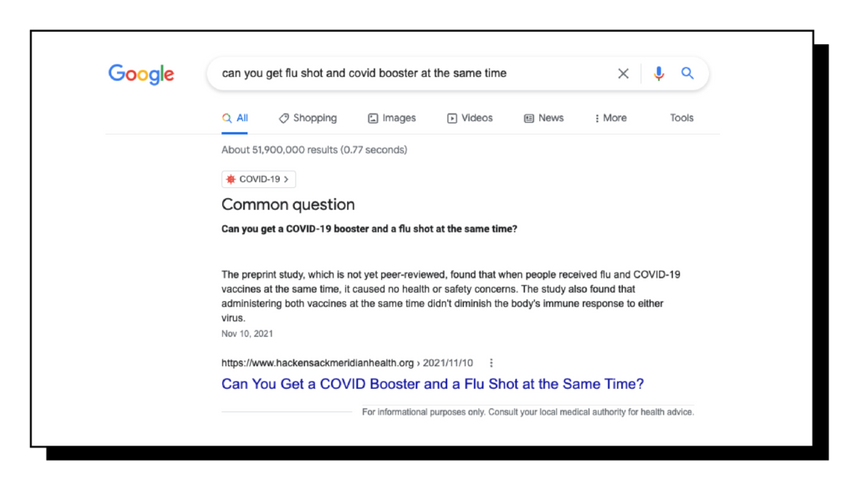

Interestingly, searchers want to learn about combining the COVID booster with their flu shot.

The sites answering these questions are mostly private hospitals explaining that you can indeed get both at the same time. Meanwhile, the CDC’s own flu shot FAQ page barely mentions COVID. There is a tremendous public health opportunity for officials to combine information about the two vaccines.

Pandemic Developments in 2022

Even two years into the pandemic, people around the world still struggle to adapt to our new normal. Are they allowed to travel right now? What kind of mask should they wear? How can they get tested? This section examines a few of these COVID-induced life changes in 2022.

Travel

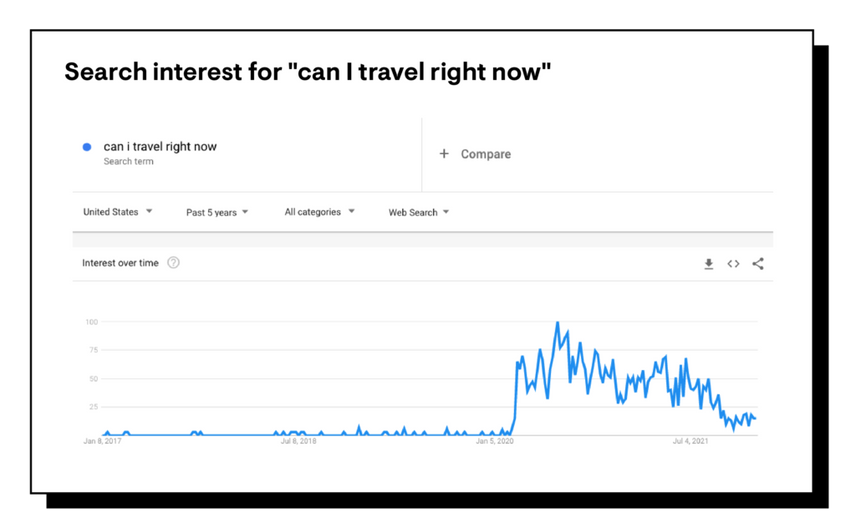

The pandemic impacted consumer traveling habits and the broader travel industry perhaps more than any other. Travel uncertainty remains an issue going into 2022.

Curiously, though, people are searching “can I travel right now” at the lowest rate in the entire pandemic so far.

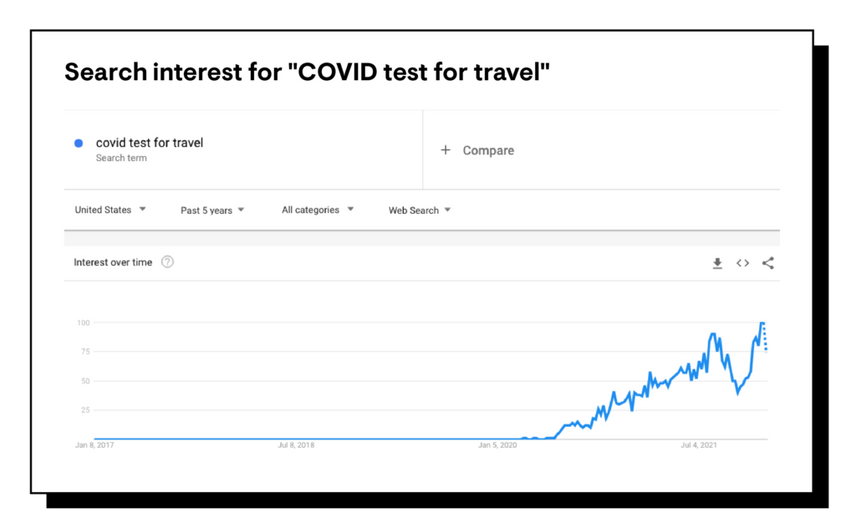

It may be that people are less concerned about whether they can travel, but rather about how to travel safely. This is confirmed by searches for “COVID test for travel,” which are at their highest point in the pandemic after a dip in fall 2021.

Masking

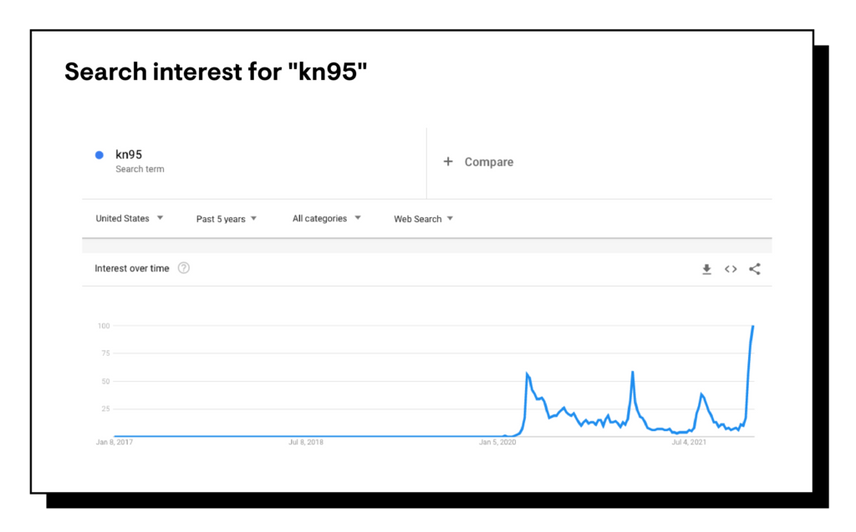

People are concerned that a regular surgical or cloth mask might not be enough to protect against Omicron transmission. Search interest in “kn95,” a more robust face covering, is the highest it has ever been.

You can trace the history of the pandemic through search interest in KN95 masks, from the initial onset of COVID in 2020 to the subsequent waves the following winter and summer.

With Omicron, even more people understand the importance of quality masks and being required to wear them in certain settings. This has led to the highest interest in KN95s yet.

Lockdowns

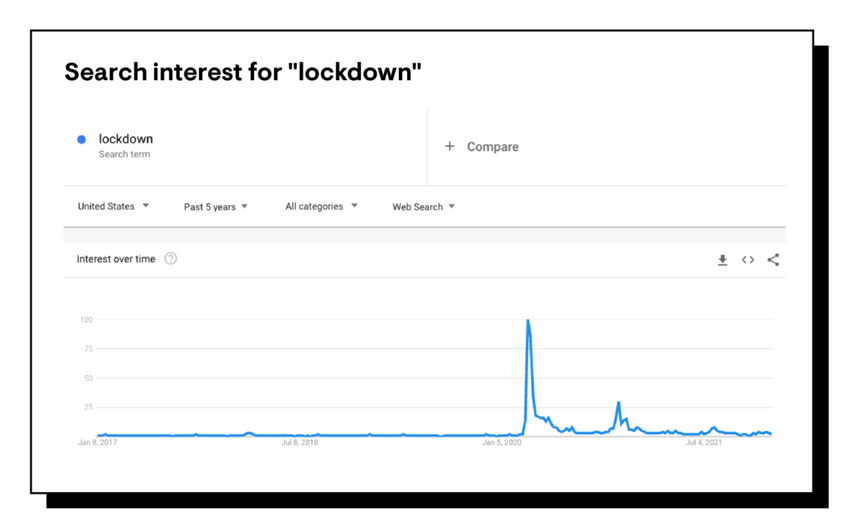

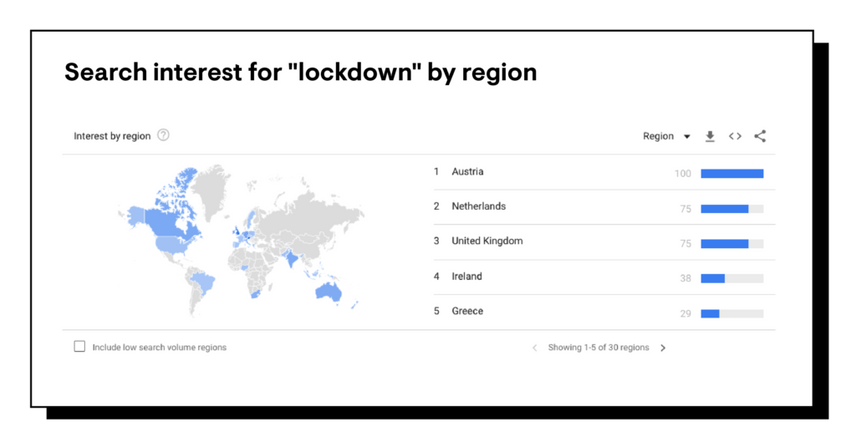

Lockdowns to prevent the spread of COVID-19 are likely a thing of the past. Certainly we have seen little interest in the U.S for additional closures, which is reflected by search interest in “lockdown,” which spiked early in the pandemic but barely budged during the omicron surge.

Recent search data can also inform us of which countries are utilizing lockdowns to control the spread. This is evidenced by the distribution of worldwide “lockdown” search interest over the past thirty days:

Austria and the Netherlands have the highest level of lockdown searches, reflecting recent lockdown strategies in both countries. Austria during the holidays made the decision to extend their partial lockdown to at least January 10. The Netherlands was more strict with their lockdown regulations and as early as December 20, 2021, they made the decision to be on lockdown till mid-January.

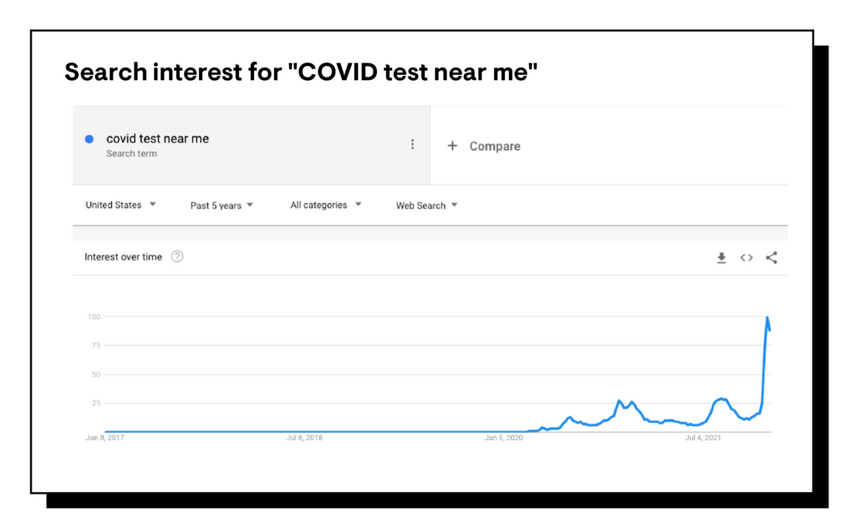

Testing, Testing, Testing

Demand for COVID tests in the U.S. is higher than ever, as people try to keep themselves and others safe by determining their infectiousness. Our hypothesis is that between the Omicron variant, the holidays, requirement for travel, and possible return to work requirements could all be contributing to these trends.

Unfortunately, availability of COVID tests has not kept pace with this skyrocketing demand.

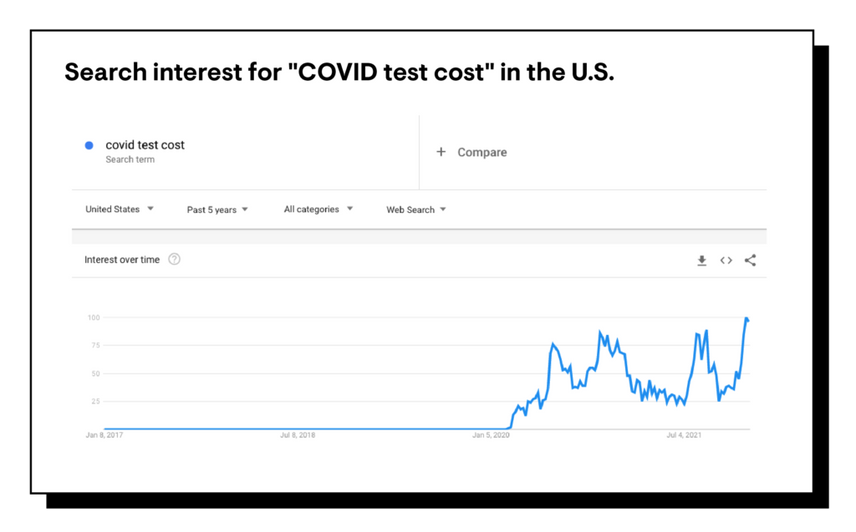

Testing cost is also a consideration. Early in the pandemic, the U.S. federal government limited the costs to consumers of COVID testing and treatment. According to the Department of Health and Human Services, the U.S. has made COVID tests be available to everyone, whether someone is insured or not, and it’s possible to get them free or at a low cost across the country. That being said, labs and testing facilities can charge whatever they want and price gouging continues to be a widespread concern.

Indeed, searches for “covid test cost” in the U.S. are at the highest levels yet:

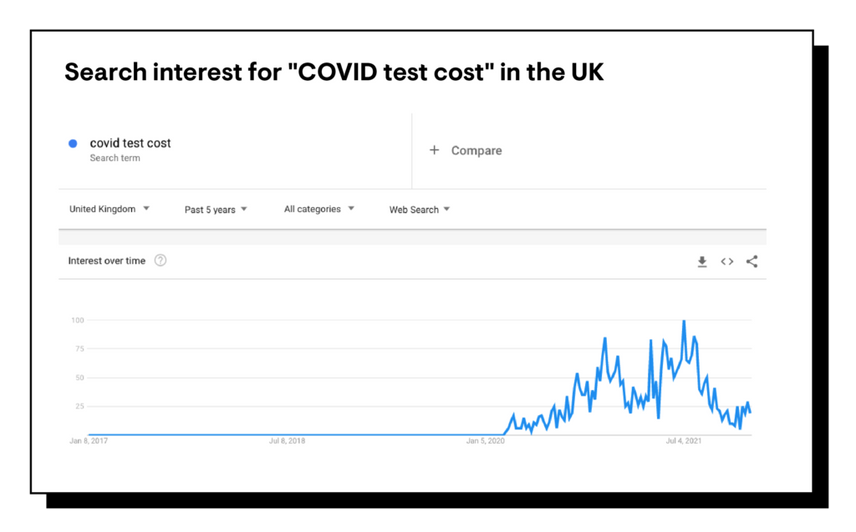

Compare this to the U.K., where COVID tests are widely available and free :

Relative search interest is much lower in the U.K. than in the U.S. for “covid test cost.” The search data clearly reflects the differing government policies around testing.

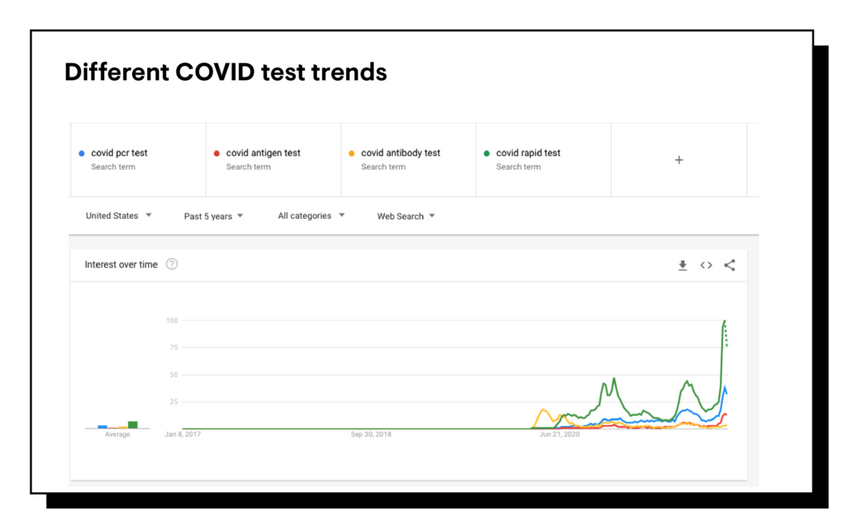

We then compared historic demand for different types of COVID tests throughout the pandemic: PCR, antigen, antibody, and rapid tests.

Early in the pandemic, antibody tests were the most popular type of lab work. This is likely because PCR tests were not easily accessible or widespread. As PCR tests became more widely available, search demand began to grow, with subsequent spikes during each wave of COVID. PCR demand has remained quite high, second only to the query “rapid test,” which seems to be the new standard for determining infectiousness.

Treatment Updates

We are inching towards more robust treatment for COVID-19, which, along with vaccinations and masking, will be crucial for reducing hospitalizations and deaths.

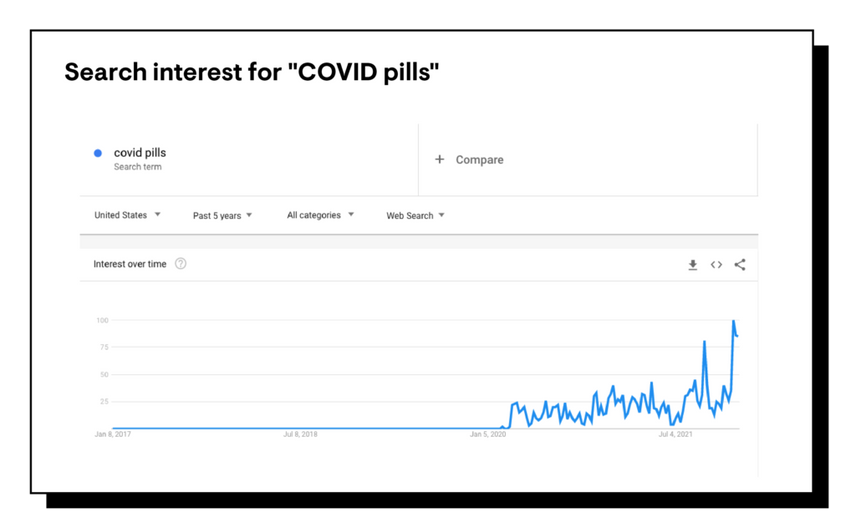

The FDA recently authorized an antiviral pill from Merck for treating COVID, joining the existing Pfizer pill as treatment.

Interest in COVID pills spiked in fall 2021 as they were approved, but is currently at the highest level yet.

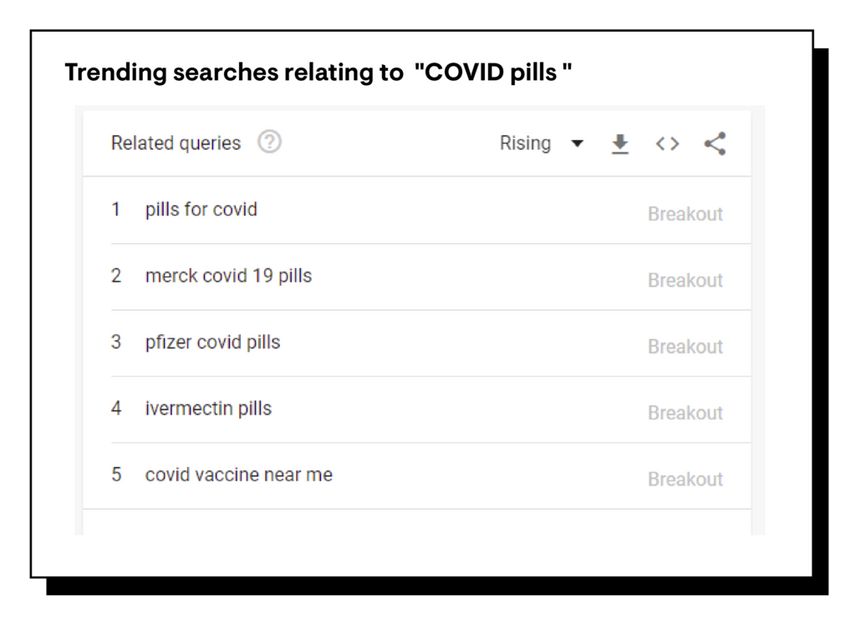

As far as brands, Merck and Pfizer are both associated with new treatment regimens:

Continue to Leverage Search Trends to Understand Behavior

The pandemic continues to bring global uncertainty, but search data offers us insight into human behaviors that can be used to understand and improve policy. We hope the pandemic will wind down in 2022, but until then it's up to all of us to remain vigilant and listen to the experts in order to make the world safer for everyone.